What is CalEITC?

The California Earned Income Tax Credit (CalEITC) is a cash-back tax credit designed to put money in the pockets of low-income working families and individuals. The goal of CalEITC is to help working families with low incomes better afford fundamental necessities.

This credit has the potential to reduce the amount you owe or even increase your tax refund!

Who is Eligible?

Families with children ages 6 or under,

Workers with income up to $30,000,

Self-employed workers,

Individuals whose income does not require them to file taxes,

Individuals who have never claimed the credit,

Seniors 65+ years old, OR

Young adults between 18-24 years old

EITC Federal Credit

Californians that qualify for the CalEITC will likely also qualify for the Federal EITC. Applying the credit will help to significantly boost household income for eligible families and individuals. To get your cashback tax credits, simply file your 2019 state and federal tax returns.

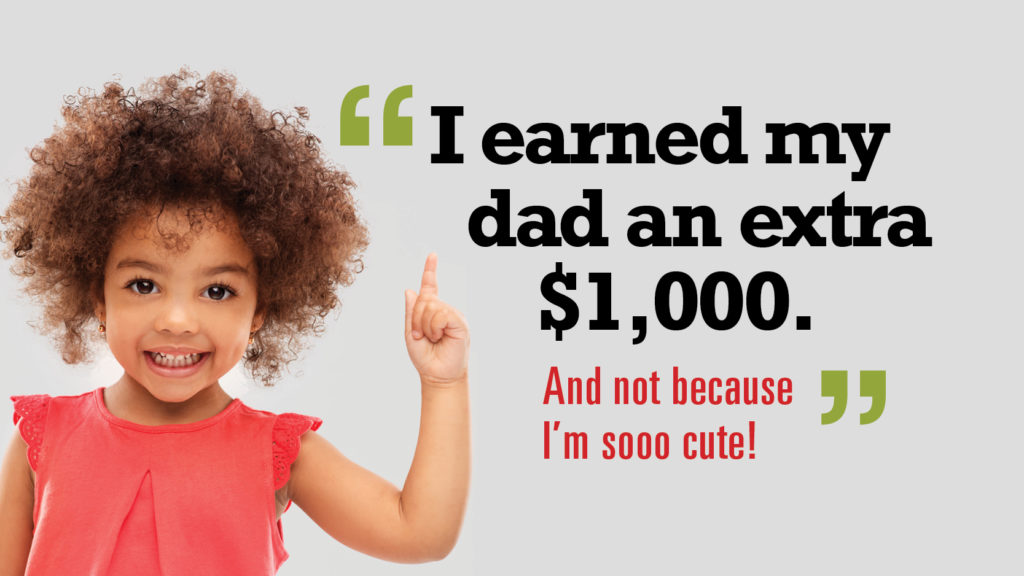

Young Child Tax Credit

If you qualify for CalEITC and have a child under the age of 6, you may also qualify for the Young Child Tax Credit (YCTC). Together, these state credits can put hundreds or even thousands of dollars in your pocket.

Filing your state tax return is required to claim both of these credits.

Discover More

Interested in saving some money or getting money back this tax season?!

To learn about CalEITC, Call 2-1-1 or visit https://caleitc4me.org/